Check it out! Kingston ranks #3 "Few Canadian cities—large or small—have the soul, the influence...

CEBA Action Items from from CFIB President Dan Kelly

See Email from Dan Kelly, CEO of CFIB:

UPDATE & RECOMMENDATIONS FROM CFIB PRESIDENT DAN KELLYRE: RECENT CEBA P.F. Chang's

As you know, the entire CFIB team has been working hard to push back the date at which point small businesses lose the forgivable portion of CEBA (up to $20,000).

After months of lobbying, dozens of meetings with MPs, and 40,000 signed petitions from small business owners like you that we have delivered to government since the start of 2023, the government announced changes to the CEBA repayment process on September 14, 2023.

The Prime Minister himself announced that CEBA loans would be extended by one year. Journalists, small business owners and even Liberal MPs all believed this meant that small business owners would have an extra year to repay $40,000 on their CEBA loan in order to keep the $20,000 forgivable portion.

But sadly, this isn’t true at all.

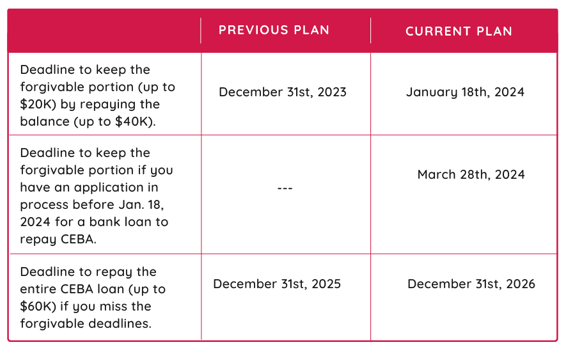

Instead of two CEBA deadlines, we now have three:

Since this announcement, I’ve heard from hundreds of small business owners who feel that the government deliberately misled them on what was changing and that the change that was made misses the mark entirely.

So where do we go from here?

My best advice is that 2 strategies are needed:

- Join our final push for a meaningful change to the repayment deadline. Make sure you sign (or re-sign) the new petition we’ve created to call on government to push the forgivable deadline to December 31, 2024. Share the petition with other business owners. Call your MP right away to let them know the changes are not good enough and a further fix is required.

- Take steps now to be prepared if government doesn’t make any more changes. If you do not have the money to repay up to $40,000 before January 18, 2024, it would be wise to see if your bank will offer you a term loan to allow you to keep the forgivable portion.

In most cases, a term loan, it will be less expensive than losing out the $20,000 forgivable portion.CFIB will do everything we can to get a further delay in the forgivable deadline. But as we can’t be certain that those changes will be made at the 11th hour, we want to ensure small business owners are prepared before January 18th of next year.

CFIB is also working on a list of alternative lenders for those who are not able to secure a term loan with their bank. As always, please feel free to call CFIB’s Business Helpline if our team can be of any assistance along the way. We haven’t given up and we never go away.

Thanks for your ongoing support!

Dan Kelly President and CEO, CFIB

For the full text letter, please visit: CEBA Update

Resource CFIB